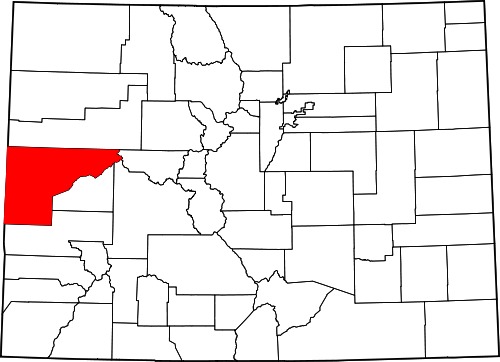

Mesa County, Colorado, located outside of Grand Junction, was one of the hardest hit regions during the oil shale boom and bust of the 1980s. In the bust’s wake, over 400 subdivisions containing about 4,000 lots throughout the County were left with outstanding development improvement agreements.

To address this issue, Mesa County put several measures in place to ensure these complications would not arise in the future.

To address this issue, Mesa County put several measures in place to ensure these complications would not arise in the future.

A new Development Improvements Agreement form and financial guarantees were negotiated with the banks and development community. In addition, a new financial guarantee called the “Subdivision Disbursement Agreement” was approved. This is an agreement between the financial institution that finances the developer’s construction loan and the County.

In order to eliminate duplicate loans and guarantees to the bank, the lender agrees to ‘set aside’ a portion of the construction loan to guarantee the itemized cost of the improvements in the Development Improvements Agreement.

The local partnerships have worked well in Mesa County for the last 20 years, and this guarantee is used to prevent incomplete improvements.

The policies that Mesa County put in place after the oil shale bust of the 80’s are still employed today. They allowed the County to avoid an overabundance of incomplete subdivisions as a result of the recent real estate collapse.

Of the Colorado counties analyzed in this study, Mesa County had the lowest percentage of vacant subdivision parcels to total subdivision lots. Other counties may benefit from adopting some of Mesa County’s practices to help mitigate the issues affiliated with an abundance of incomplete subdivisions.

Mesa County, CO Development Improvements Agreement

2010_Development_Improvement_Agreement_SampleDownloaded from ResilientWest.org

a project of

Resilient Communities and Watersheds

- Challenges:

- fiscalhealth

- State:

- colorado

- Scale:

- site, neighborhood